WELCOME TO MY BLOG!

Real Tips, Unforgettable Advices, Market Updates and Much more!

Whether you’re buying, selling, or just curious about the market, you’ll find the tools, tips, and guidance you need right here.

Read It Now

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Mortgage rates have been the monster under the bed for a while. Every time they tick up, people flinch and say, “Maybe I’ll wait.” But here’s the twist. Waiting for that perfect 5-point-something rate could end up haunting your wallet later.

The Magic Number

According to the National Association of Realtors (NAR):

“. . . a 30-year fixed rate mortgage of 6% would make the median-priced home affordable for about 5.5 million more households—including 1.6 million renters. If rates were to hit that magic number, it’s likely that about 10%—or 550,000—of those additional households would buy a home over the next 12 or 18 months.”

When the market hits that mortgage rate sweet spot, as expert forecasters are starting to say is more likely in 2026, the psychological shift to lower rates will kick in for more of today’s hopeful buyers. That will unleash some pent-up demand that’s been waiting on the sidelines, and the increase in activity will cause prices to rise.

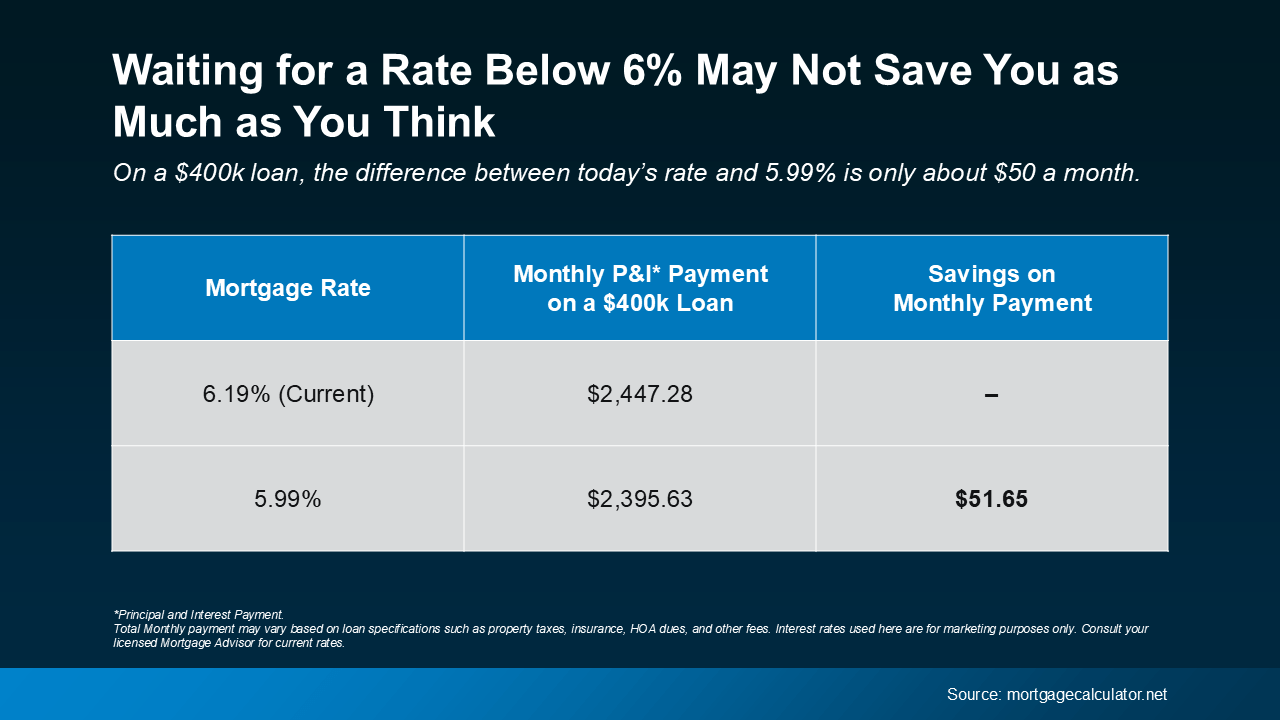

And while a 5.99% rate might sound like a big win, if you’re waiting for that number to make your move, it might not actually save you as much as you think. Here’s how the math looks when you run the numbers (see chart below):

On a $400,000 mortgage, the difference between today’s rate (around 6.2%) and 5.99% is roughly $50 a month. That’s less than many people spend on weekly coffee runs or occasional DoorDash orders. And as prices tick up with more buyers in the market, that could quickly negate any of your potential savings.

So, if you’re waiting for 5.99%, that difference might not be worth missing out on today’s opportunities, like having more homes to choose from, better negotiation leverage with today’s sellers, and fewer buyers out there looking for the same houses.

Because the reality is, those benefits start to slip away when more buyers begin to make their moves – and a rate under 6% is exactly they’re waiting for.

Why Acting Now Makes Sense

Jessica Lautz, Deputy Chief Economist and VP of Research at NAR, says:

“Over the last 5 weeks, mortgage rates have averaged 6.31%.This has provided savvy buyers a sweet spot to reexamine the home search process with more inventory, widening their choices.”

And like Matt Vernon, Head of Retail Lending at Bank of America, notes:

“Rather than waiting it out for a rate that they like better, hopeful homebuyers should assess their personal financial situation—if the house is right for them, and the upfront and monthly payments are affordable, it could be the right chance to make a move.”

Bottom Line

If moving at today’s rate scares you, remember, waiting doesn’t always pay off. Once rates dip below 6%, as some experts project they’ll do next year, more buyers (and higher prices) will be back.

So, don’t be afraid of today’s mortgage rates. Because if you’re ready, this might just be your chance to make your move before the market wakes up again.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

More educational content about Real Estate

Follow me on all social networks

FAQS

How Can I Contribute a Travel Story to Your Website?

We welcome contributions from fellow adventurers! To share your travel story with us, please navigate to the "Submit Your Story" section on our website. There, you'll find detailed guidelines on how to submit your article, along with our preferred content format. We're excited to hear about your adventures and share them with our community of travelers.

How Do You Ensure the Accuracy of Your Travel Guides?

Accuracy is paramount to us. Our team of experienced writers and researchers conducts thorough research and fact-checking for every travel guide we publish. We also regularly update our content to reflect changing conditions and recommendations. However, please note that travel information can change, so it's always a good idea to verify details with local sources before your trip.

Do You Offer Personalized Travel Planning Services?

Currently, we don't provide personalized travel planning services. Our focus is on creating comprehensive travel guides, inspiring stories, and useful tips to help you plan your own adventures. However, our website is packed with resources to assist you in crafting the perfect itinerary for your trip, from destination recommendations to packing guides and more. If you have specific questions or need advice, feel free to reach out through our community forum; our fellow travelers are always eager to help!

ALL Right Reserved to Jessica Taylor. Copyright 2025.